Table of Contents

- Why IRAs Require Tax Planning in the First Place

- Common IRA Tax Planning Goals

- Why Local Tax Help Matters

- Tax Planning vs. Tax Filing

- Roth Conversions and Timing

- Charitable Giving and IRA Distributions

- Estate Planning Considerations

- IRA Distribution Help for Real-World Situations

- Mistakes That Professional Help Can Prevent

- Final Thought: Strategy Unlocks the Real Value

Long-term savings require more than deposits and market timing. As retirement approaches, the focus shifts from building wealth to preserving and distributing it efficiently. This shift brings a new challenge—tax planning for IRAs. While Individual Retirement Accounts (IRAs) were built to encourage saving, their tax implications can reduce the benefit of decades of discipline if not handled properly. For this reason, IRA tax planning becomes a crucial part of any retirement strategy.

Many savers reach the withdrawal stage without realizing that the IRS has rules on distributions, taxes owed, and penalties applied. What was intended as a nest egg can turn into a tax burden if distributions are mistimed or structured poorly. With professional IRA tax planning, this burden can be reduced. For those in Georgia, Texas, or Florida, assistance from an IRA tax planner near you can help turn confusion into clarity and preserve more of what was earned.

“The typical family of four with employer-based health insurance is not the same as the typical family of four.”

It’s better-off.

Why IRAs Require Tax Planning in the First Place

An IRA is a tax-advantaged retirement account designed to hold contributions and grow them over time. But unlike Roth IRAs, which offer tax-free withdrawals under certain conditions, traditional IRAs require taxes to be paid when money is taken out. This deferred-tax feature becomes a liability if the distributions are large, unplanned, or pushed into higher income years.

The IRS requires Required Minimum Distributions (RMDs) starting at age 73 for most individuals. If RMDs are not taken, a penalty of 25% on the amount not withdrawn may apply. Even if funds are not needed, the account owner must withdraw a set percentage annually. For this reason, tax strategy—not just investment performance—determines how much of the retirement fund is truly retained.

IRA tax planning ensures that distributions are timed properly, taxed at the lowest possible rate, and coordinated with Social Security, pensions, or part-time income.

More on RMD rules can be reviewed here:

https://www.healthcare.gov/glossary/required-minimum-distribution-rmd/

Common IRA Tax Planning Goals

When IRA planning is approached strategically, several goals can be achieved:

- Minimizing taxes on distributions

- Avoiding RMD penalties

- Smoothing income levels year-over-year

- Reducing taxable estate size

- Coordinating Roth conversions

- Managing Medicare premium brackets

Retirees often discover that even small adjustments—such as withdrawing slightly before RMD age or spreading conversions over multiple years—can protect tens of thousands in taxes. Without planning, distributions may overlap with peak income or cause unexpected Medicare surcharges.

Why Local Tax Help Matters?

Each state has unique conditions that influence IRA strategies. While federal rules apply across the country, state tax codes, income sources, and retirement trends vary.

In Florida, there is no state income tax, but coordination with property and insurance costs remains important. In Texas, energy-sector retirees often have stock-heavy portfolios that carry their own risks. In Georgia, early retirees face mixed tax rules that can affect pension and IRA distributions differently.

Working with a local IRA tax planner ensures strategies are customized. Advisors at ASM Insurance & Financial Services help clients across these regions structure their withdrawals, calculate projected tax brackets, and adjust portfolio allocations in a tax-conscious way.

The term “IRA tax planner near me” should not lead only to national call centers. It should bring you closer to someone who understands your zip code, income sources, and state-specific concerns.

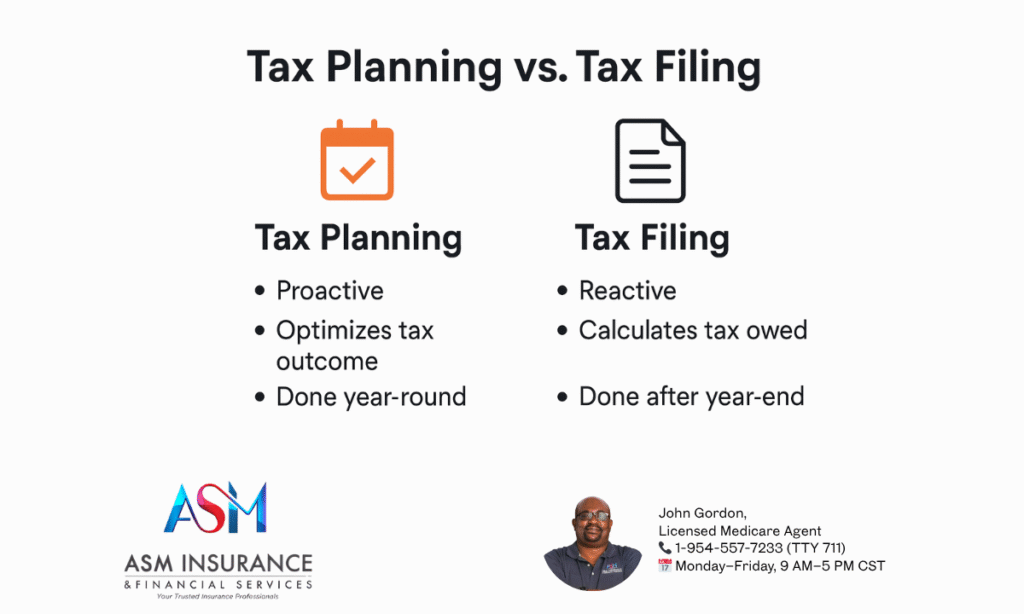

Tax Planning vs. Tax Filing

It is often assumed that an accountant or tax preparer will handle IRA taxes automatically. But tax planning is proactive, while tax filing is reactive. By the time the return is filed, most opportunities to optimize IRA distributions are gone.

A true IRA tax plan is built throughout the year. Withdrawals are mapped against income expectations. Social Security benefits are timed. Roth conversions are scheduled to avoid bracket jumps. Charitable donations, known as Qualified Charitable Distributions (QCDs), are used to offset RMD obligations without increasing taxable income.

When handled properly, an IRA account becomes a source of reliable income—not a tax surprise. When ignored, it can shift a retiree into higher tax tiers just as they hope to enjoy financial freedom.

Roth Conversions and Timing

One of the most strategic tools in IRA tax planning is the Roth conversion. This allows traditional IRA funds to be moved into a Roth IRA, triggering taxes now but avoiding them in the future. The key lies in converting during years when income is low and future brackets are expected to rise.

A common window appears between retirement and the start of Social Security or RMD age. During this time, taxable income may be low, creating an ideal bracket for partial Roth conversions. These conversions are irreversible and must be planned with attention to income thresholds and Medicare premiums.

Agents at ASM Insurance & Financial Services work closely with CPAs and estate planners to structure these conversions. Long-term forecasts are developed to minimize tax drag and provide future tax-free growth.

Charitable Giving and IRA Distributions

Retirees who donate to qualified charities can benefit from Qualified Charitable Distributions. These allow individuals over age 70½ to donate up to $100,000 directly from their IRA to a charity. This amount satisfies the RMD and avoids inclusion in taxable income.

This is especially useful for those who do not itemize deductions. Instead of losing the tax benefit of charitable giving, the IRA provides a direct pipeline—lowering income while fulfilling philanthropic goals.

Healthcare nonprofits often qualify, and additional guidance on tax-efficient giving can be found on:

https://www.healthcare.gov

Estate Planning Considerations

Many individuals plan to pass unused IRA assets to children or spouses. However, inherited IRA rules have changed. Under the SECURE Act, most non-spouse beneficiaries must now withdraw the entire inherited IRA within 10 years, increasing the likelihood of a high tax bill.

Proper planning can minimize this impact. Naming trusts as beneficiaries, staggering conversions, or dividing assets between Roth and traditional IRAs are a few of the solutions used. Life insurance, funded by IRA withdrawals, can also be used to pass on tax-free assets to heirs.

The estate planning layer of IRA tax planning must be treated with care. With professional help, burdens on beneficiaries can be reduced and legacies preserved.

IRA Distribution Help for Real-World Situations

The process of withdrawing funds from an IRA is often more complex than it appears. Each year must be reviewed for:

- Total income sources

- Taxable vs. non-taxable components

- Impact on healthcare subsidies

- Social Security taxation thresholds

For retirees under age 65, ACA health coverage and premium subsidies may be affected by IRA withdrawals. A single miscalculated withdrawal can result in the loss of hundreds or thousands in subsidies.

This is why IRA distribution help is not just a technical service—it is a safeguard against costly mistakes. A licensed professional reviews not only the IRA itself, but the financial ecosystem in which it exists. Services from ASM Insurance & Financial Services include distribution planning that supports healthcare affordability while meeting tax obligations.

Mistakes That Professional Help Can Prevent

- Missing the first RMD and incurring penalties

- Triggering Medicare surcharges through lump-sum withdrawals

- Paying higher taxes by taking all distributions in a single year

- Failing to coordinate with Social Security start dates

- Misunderstanding how distributions affect ACA subsidy eligibility

Avoiding these mistakes saves more than tax—it saves stress, lost benefits, and family friction. With professional help, the IRA becomes a tool for stability rather than uncertainty.

Strategy Unlocks the Real Value

IRA tax planning is not about avoiding responsibility. It is about understanding timing, sequence, and strategy. What took decades to build can be lost without preparation, or preserved through one timely conversation.

In Georgia, Texas, and Florida, countless retirees face these decisions each year. When guided correctly, the outcome is smoother, the taxes are lower, and the income is more reliable. That guidance is available. And that future can be planned.

ASM Insurance & Financial Services helps turn retirement funds into real-world security—through thoughtful, year-round planning that respects your effort and protects your outcome