Index

- Medicare: Federal Health Insurance for Seniors and Certain Disabilities

- Key Components of Medicare

- Part A (Hospital Insurance)

- Part B (Medical Insurance)

- Part C (Medicare Advantage)

- Part D (Prescription Drug Coverage)

- Medicaid: Joint Federal and State Program for Low-Income Individuals

- Key Features of Medicaid

- Dual Eligibility: Qualifying for Both Medicare and Medicaid

- Why Understanding the Difference Matters

- Need Assistance Navigating Medicare and Medicaid?

- Sources

Understanding the differences between Medicare and Medicaid is crucial for making informed decisions about your healthcare coverage. Both programs serve distinct populations and offer different benefits, and navigating them can be complex. If you find yourself uncertain about which program applies to your situation, seeking guidance from a licensed Medicare agent can provide clarity and ensure you receive the coverage you need.

“If a child, a spouse, a life partner, or a parent depends on you and your income, you need life insurance.

Suze Orman”

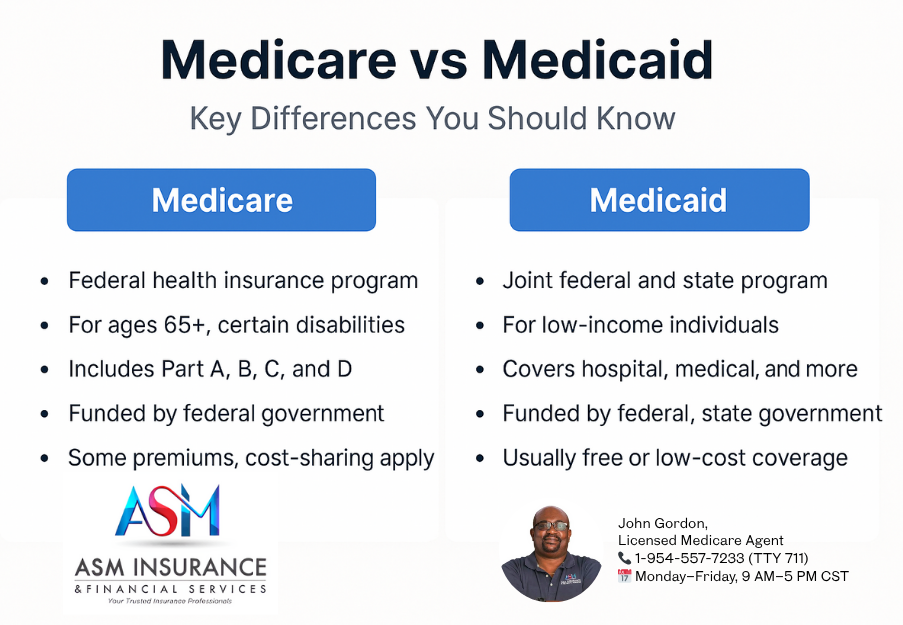

Medicare: Federal Health Insurance for Seniors and Certain Disabilities

Medicare is a federal program primarily designed for individuals aged 65 and older, as well as younger people with specific disabilities or conditions like End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS). Eligibility is based on age or qualifying medical conditions, regardless of income.National Council on Aging

Key Components of Medicare:.

- art A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage): An alternative to Original Medicare, offered by private companies approved by Medicare, combining Parts A and B and often Part D.

- Part D (Prescription Drug Coverage): Adds prescription drug coverage to Original Medicare and some Medicare Cost Plans

Medicare typically requires beneficiaries to pay premiums, deductibles, and coinsurance. It’s important to note that while Medicare covers many healthcare services, it doesn’t cover all costs, such as long-term care, dental, vision, and hearing services.Healthline+4Wikipedia+4Verywell Health+4Verywell Health

Medicaid: Joint Federal and State Program for Low-Income Individuals

Medicaid is a joint federal and state program that provides health coverage to eligible low-income individuals and families, including some low-income adults, children, pregnant women, elderly adults, and people with disabilities. Eligibility and benefits can vary significantly from state to state.HHS.gov

Key Features of Medicaid:

- Eligibility: Based on income, household size, disability, family status, and other factors.

- Coverage: Includes a broad range of health services, often covering services not typically covered by Medicare, such as long-term care and personal care services.Wikipedia

- Cost: Medicaid enrollees typically pay little to no cost for covered services, though some states may impose small copayments.HHS.gov

Because Medicaid is administered by individual states within federal guidelines, the specific services covered and eligibility requirements can differ. It’s essential to check with your state’s Medicaid office for the most accurate information.

Dual Eligibility: Qualifying for Both Medicare and Medicaid

Some individuals qualify for both Medicare and Medicaid, known as “dual eligibles.” In these cases, Medicare serves as the primary payer for healthcare services, and Medicaid acts as the secondary payer, covering additional costs like premiums, deductibles, and services not covered by Medicare.

Dual eligibility can provide comprehensive coverage and reduce expenses. However, navigating the coordination between the two programs can be complex, and it’s advisable to consult with a knowledgeable Medicare representative to understand how the benefits work together in your specific situation.

Why Understanding the Difference Matters?

Confusing Medicare and Medicaid can lead to gaps in coverage or unexpected healthcare costs. For instance, assuming Medicare covers long-term nursing home care can result in significant out-of-pocket expenses, as this is typically covered by Medicaid. Conversely, not enrolling in Medicare when eligible can lead to penalties and delayed coverage.

Given the complexities and variations in coverage, especially with Medicaid’s state-specific rules, it’s crucial to seek personalized advice. Licensed Medicare agents can provide guidance tailored to your circumstances, ensuring you make informed decisions about your healthcare coverage.

Need Assistance Navigating Medicare and Medicaid?

If you’re in Florida, Texas, Georgia, or elsewhere and need help understanding your healthcare coverage options, don’t hesitate to reach out. Our experienced Medicare agents are here to provide personalized guidance and support.

Contact John Gordon, Licensed Medicare Agent

📞 1-954-557-7233 (TTY 711)

📅 Monday–Friday, 9 AM–5 PM CST

Whether you’re exploring Medicare, Medicaid, or both, we’re committed to helping you find the coverage that best fits your needs.

Sources:

- U.S. Department of Health and Human Services: What’s the Difference Between Medicare and Medicaid?HHS.gov

- Medicare.gov: Medicaid

This article is intended for informational purposes only and does not constitute legal or financial advice. For personalized assistance, please consult a licensed Medicare agent or your state’s Medicaid office.